Download BankFive Overdraft Privilege Terms and Conditions

BankFive Overdraft Privilege Terms and Conditions

Rev 4/2025

BankFive Overdraft Privilege is a discretionary service used to cover inadvertent overdrafts. We are not obligated to pay any item presented for payment if your account does not contain sufficient funds. However, if you maintain your checking account in good standing (defined as making regular deposits and bringing your account to a positive balance at least once every 30 days for a minimum of 24 hours) and there are no delinquent loans with us, legal orders, liens or levies outstanding, we may cover your overdrafts.

We use the available balance method to determine if there are sufficient and available funds in your account to pay an item presented for payment and to assess an insufficient funds charge. The available balance in your account reflects deposits and transactions that have been posted to your account and transactions that have not posted to your account, including the following: checks you have written, if applicable; deposit holds, and holds on debit card transactions that have been authorized but not yet posted (i.e., preauthorization holds). Those pending transactions and holds reduce your available balance. For example, if you have $100 in your account and there is a pending transaction of $30, then your available balance is $70 because the pending $30 transaction reduces your available account balance.

An insufficient balance could result in several ways, such as:

- the payment of checks, electronic funds transfers, ATM withdrawals, or other withdrawal requests;

- payments authorized by you;

- the return of unpaid items deposited by you;

- the imposition of bank service charges

If we honor an item for you that is presented against insufficient funds, the amount of that item PLUS the bank's Insufficient Funds Charge of $35.00 (per item) will be deducted from your account. This fee is applicable on a per item basis for each item that is presented against insufficient funds and paid. This fee is reduced to $5.00 for account holders 65 and older.

Eligibility - No application is required for our BankFive Overdraft Privilege; eligibility is at the sole discretion of BankFive and is based on you managing your checking account in a responsible manner. Must be 18 or older to be eligible.

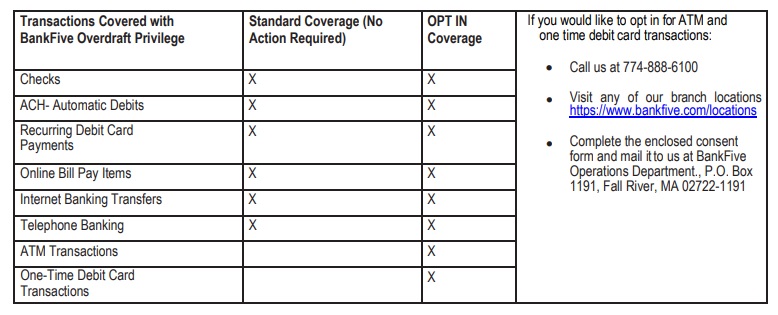

Transactions Covered - BankFive Overdraft Privilege applies to overdrafts caused by checks, in-person withdrawals, automated clearinghouse (ACH) transactions, preauthorized automatic transfers, internet banking, mobile banking and telephone banking transactions. ATM and one time debit card transactions will not be covered by this service unless you have elected to OPT IN to this service. You should note that your Overdraft limit will NOT be reflected in your balance provided by a teller, at the ATM, through our Telephone Banking Line or through Online Banking.

Please be aware that the order of payments may create multiple overdrafts during a single banking day for which you will be charged a $35.00 (per item) Insufficient Funds Charge for each overdraft paid. Keep track of your account balance and your transactions to avoid this result. BankFive will pay a maximum of 6 overdraft items per day, for a total maximum Insufficient Funds Charge per day of $210.00. After 6 items and corresponding $35.00 Insufficient Funds Charge has been paid out of the Overdraft Privilege limit, any additional items presented for payment will be paid without the fee assessment, provided you have enough funds in your Overdraft Privilege limit to cover the items presented in excess of 6. This limit does not apply to business accounts.

Any item $5.00 or less that creates an overdraft will not be charged a fee. Additionally, any item that creates an overdraft balance of $5.00 or less regardless of the item amount will not be charged a fee.

Opt Out - This is an expensive way of handling your account and you have the option to have this service removed at any time by calling us at 774-888-6100, writing us at BankFive, Attn: Operations Department, P.O. Box 1191, Fall River, MA 02722-1191 or contacting your local BankFive office. It is important for you to consider that by opting out of this service without some other form of overdraft plan such as an account transfer or line of credit (which is offered to qualified accounts) you are instructing us to return unpaid items presented against insufficient funds.

Payment Order of Items - The order in which items are presented may affect the total fees assessed to your account. To assist you in avoiding overdrafts on your account with us, we are providing you with the following information regarding how we process checks, ATM withdrawals, preauthorized electronic funds transfers, one time debit card (also referred to as point-of-sale or POS) transactions and other items presented for payment out of your account. In general we process your inclearing checks and ACH items at the beginning of each business day from lowest to highest dollar amounts. In addition, inclearing checks and ACH items may clear your account throughout the day from lowest to highest dollar amount. ATM and POS transactions are processed throughout the day as they are conducted. We reserve the right to change this order of payment without notice to you if we suspect fraud or possible illegal activity affecting your account.

We commonly receive items electronically to be paid out of your account multiple times per day in what is referred to as presentment files. We can receive more than one ACH presentment file per day. Each presentment file received commonly contains a large amount of a specific type of item (check, ACH, or ATM/POS). A presentment file may contain multiple items to be paid out of your account. When we receive a presentment file that contains multiple items to be paid out of your account, the items will be paid in the order listed above.

If your account is enrolled in the BankFive Overdraft Privilege Program, the order in which items are paid from your account is important. If there is not enough money in your account to pay all of the items that are presented, we may (a) return the item unpaid, or (b) pay the item in our sole discretion in accordance with these BankFive Overdraft Privilege Terms and Conditions, which would create an overdraft on your account. We encourage you to make careful records and practice good account management. This will help you avoid writing checks, requesting withdrawals or authorizing payments without sufficient funds and incurring the resulting fees.

We will not charge you a fee if we return the item. We may charge you a fee if we pay the item on your behalf.

If we do not pay the debit transaction or item on your behalf and return the debit or item, we will not charge you an Insufficient Funds Charge. Pursuant to NACHA Operating Rules and Guidelines and other applicable laws, an item may be presented for payment more than one time by another party.

Excessive Use - We monitor customer accounts for chronic or excessive use. If you overdraw your account more than six times in a rolling twelve month period you will be contacted to discuss alternatives and/or continued use of BankFive Overdraft Privilege.

Financial Education - Financial literacy and education helps customers make informed decisions. Heightened awareness of personal financial responsibility helps customers realize the benefits of responsible money management, understanding the credit process and the availability of help if problems occur. www.MyMoney.gov is the federal government's website for federal financial literacy and education programs, grants and other information. To request a personal financial toolkit, call 1-888-MyMoney.

Account Agreement - Your account agreement describes the duties, obligations, and rights of depositors, authorized signatories with regard to your deposit accounts. Please refer to your account agreement received at account opening. Your account agreement and this disclosure shall be construed so as to minimize conflicts between them.

Overdraft Privilege is a non-contractual courtesy which is available to individually/jointly owned accounts. The account must also be in good standing and used primarily for personal or business use. BankFive reserves the right to limit participation to one account per household or business and to discontinue this service without prior notice.

Suspension/Revocation - Your BankFive Overdraft Privilege may be suspended or permanently removed based on the following criteria:

- You are more than 30 days past due on any BankFive loan or delinquent on any other obligation to BankFive.

- You are subject to any legal or administrative orders, levy, or are currently a party in a bankruptcy proceeding.

- Your account is being reviewed for fraudulent activity or transactions.

- A ChexSystems or other negative indicator has been reported to us.

- You have an outstanding balance on an Overdraft Repayment Plan.

- Your account is classified as inactive.

- You have an unresolved prior loss with BankFive.

- We do not have a valid address for you.

BankFive may suspend your debit card if your account is overdrawn more than 30 consecutive calendar days (including the overdraft privilege if applicable). Debit cards on your account will remain suspended until you make sufficient deposits so that your account balance is positive.

We may refuse to pay an overdraft for you at any time, even though we may have previously paid overdrafts for you. You will be notified by mail of any insufficient items paid or returned that you may have. The amount of any overdraft plus our Insufficient Funds Charge of $35.00 (per item) that you owe us shall be due and payable upon demand. If there is an overdraft paid by us on an account with more than one owner on the signature card, each owner and agent, drawing/presenting the item creating the overdraft, shall be jointly and severally liable for such overdraft plus our Insufficient Funds Charge of $35.00 (per item).

What You Need to Know about Overdrafts and Overdraft Fees

An overdraft occurs when you do not have enough money in your account to cover a transaction, but we pay it anyway. We can cover your overdrafts in two different ways:

- We have standard overdraft practices that come with your account.

- We also offer overdraft protection plans, such as a link to a savings account or to a line of credit, which may be less expensive than our standard overdraft practices. To learn more, ask us about these plans.

This notice explains our standard overdraft practices.

What are the standard overdraft practices that come with my account?

We do authorize and pay overdrafts for the following types of transactions:

- Checks and other transactions made using your checking account number

- Automatic bill payments

We do not authorize and pay overdrafts for the following types of transactions unless you ask us to (see below):

- ATM transactions

- Everyday debit card transactions

We pay overdrafts at our discretion, which means we do not guarantee that we will always authorize and pay any type of transaction. If we do not authorize and pay an overdraft, your transaction will be declined.

What fees will I be charged if BankFive pays my overdraft?

Using our standard overdraft practices:

- We will charge you a fee of up to $35 each time we pay an overdraft.

- There is a limit of six (6) Insufficient Funds Charges that we can charge you on any one day for overdrawing your account.

- There is a limit of $210 on the total fees we will charge you for overdrawing your account on any one day.

What if I want BankFive to authorize and pay overdrafts on my ATM and everyday debit card transactions?

If you also want us to authorize and pay overdrafts on ATM and everyday debit card transactions, call us at 774-888-6100, contact your local BankFive office, or complete this form and present it at a branch or mail it to:

BankFive, Attn: BankFive Operations Department, P.O. Box 1191, Fall River, MA 02722-1191

If you authorize BankFive to pay overdrafts for ATM and everyday debit card transactions, you may revoke it at any time.